Welcome to our second quarterly trading update blog post where we will be going through our mission and financial highlights from the last three months, July to September.

Kristo Käärmann, our CEO and co-founder, said: “Wise’s mission is to make moving and managing money across borders faster, easier, cheaper and more transparent for everyone, everywhere. During the quarter we made strong progress: we dropped prices faster than hoped, our payments got faster, with more features for businesses, and we launched our exciting new ‘Assets’ feature for customers in the UK.

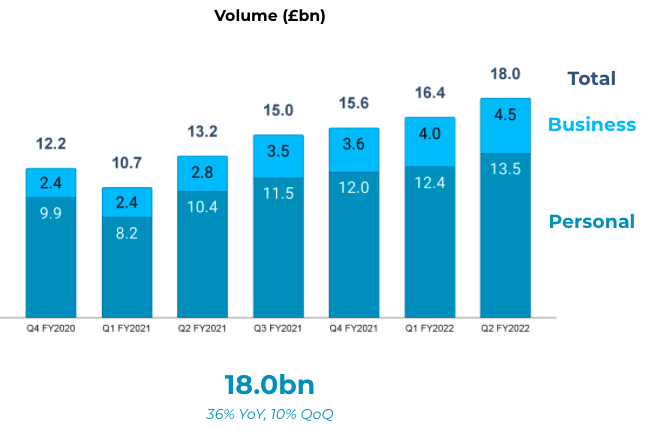

“Customers are telling us that this is working - almost 4 million customers transferred £18bn this quarter, that’s a 36% increase on last year and a 10% increase from last quarter. “So we’re moving more of the world’s volume and operating at a lower cost, the benefit from which we’ve passed onto our customers, whilst maintaining a sound sustainable business model that’s investing even more for the long term.”

Mission Highlights

Money without borders; enabling everyone to move their money across the world - instantly, transparently, conveniently and eventually for free.

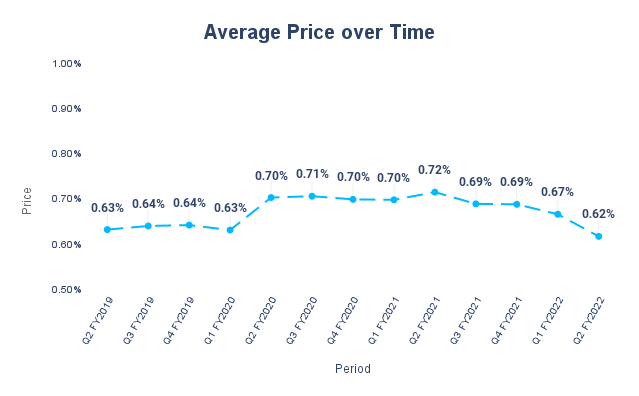

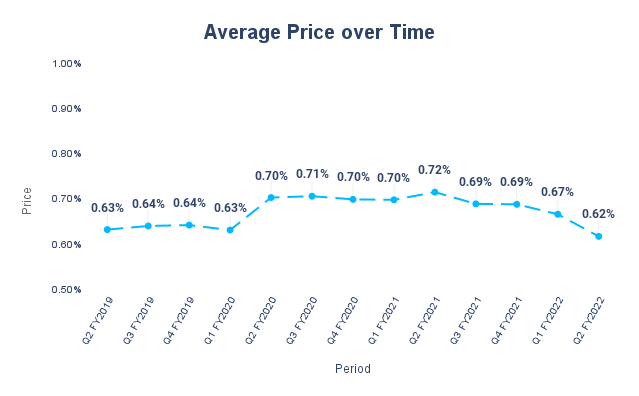

Our work to decrease costs and scale volumes enabled us to reduce prices for 1.7 million customers with customer prices† now 0.62% on average, 5bps lower than they were at the beginning of the quarter. This is an exceptional movement for a single quarter and reflects the amazing work from the team and our commitment to invest in sustainably lower prices.

40% of all transfers were instant — faster than ever

Our payments got faster too. The time it takes to complete a transfer continues to improve with 40% of all transfers delivered instantly this quarter, up from 38% in Q1.

At the same time we are increasingly convenient, for example, we integrated with a payment network in India so that Wise customers can send money to India using their smartphones, without needing to know their recipient’s bank details and have the transfer arrive within 20 seconds.

UK customers can now earn a return on the money they hold with Wise

We made further progress developing our Wise Account during the quarter with the UK launch of Assets. Assets gives customers a potential return on their balance with Wise by holding it in a different asset class, while still being able to spend and send as though it were held as cash.

New features for business customers

Our proposition for business customers was enhanced with the launch of a number of new features during the quarter including the ability to attach receipts and notes to card transactions; and enhanced controls such as the ability for an account holder to delegate tasks, payment approvals and assign spending limits to accountants and team members. Business customers in Europe can also now get verified faster thanks to a newly developed process, with 98% of European verification tasks resolved within 24 hours (up from 50% last quarter).

Working with partners

We have made further progress in serving customers through platform partners. Wise Platform has recently partnered with US neobank Sable to give their customers faster, cheaper, international money payments, available directly in the Sable app. Meanwhile, OnJuno customers can now send money directly to India, China, Europe, UK, and the Philippines straight from their account.

See here for access to the full blog post with our Mission Update.

Growth and Financial highlights

Customers

Almost 4 million customers transacted on Wise in Q2 FY2022 with the number of active personal customers growing by 22% YoY to 3.7 million. The number of active business customers grew by 44% compared to the prior year as we continue to broaden the appeal of our business proposition.

Volume

Volume, a key metric for us, grew by 36% YoY and 10% QoQ to £18.0 billion driven by strong growth in the number of active customers and growth in the average volume per customer from further adoption of the Wise account and higher volumes from business customers.

Revenue

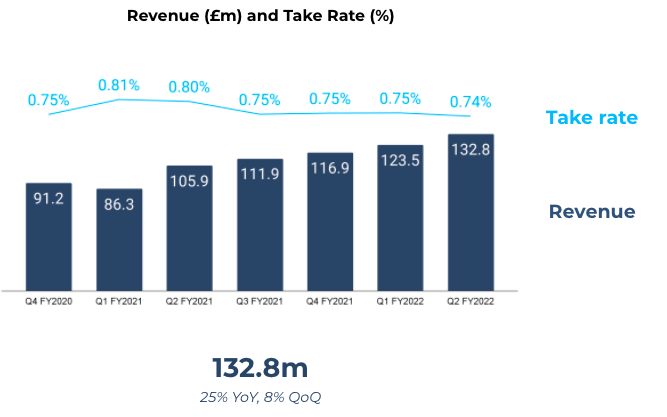

Revenue grew by 25% YoY and 8% QoQ to £132.8 million, in line with our expectations and primarily driven by the higher levels of volume seen in the quarter. We’ve worked hard to engineer and optimise away the fees we pay banks and we’ve passed on these savings to customers; a core part of our strategy is to invest in the long term sustainable value of Wise. The lower prices have of course resulted in a lower take rate, reducing from 0.80% to 0.74% YoY and from 0.75% to 0.74% QoQ, as the price drops were partially offset by revenue from other sources beyond cross-border transactions. But, at the same time we’ve seen a higher gross margin as we continue to reduce the marginal cost of a transaction.

In short, we are a stronger, more competitive business than we were at the start of the period: we move more volume at a lower price to customers, thanks to leaner infrastructure, but still generate the healthy gross margin needed to invest in our future. This demonstrates how we can move towards our mission whilst creating long term value for both customers and shareholders.

So looking ahead, our take rate is expected to be slightly lower in the second half of FY2022 compared to the first half as a result of price reductions, but we continue to expect revenue growth of low to mid 20s on a percentage basis for FY2022 over FY2021. We now expect FY2022 gross margin to be c. 65-67%, up from 62% in FY2021, subject to foreign exchange related costs continuing to remain broadly stable.

Enquiries

Martin Adams - Head of Owner Relations

martin.adams@wise.com

Abigail Daniels - Global Head of Public Relations

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Samantha Chiene

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

† Customer price is based on a fixed basket of representative currencies which reduces the effect from route mix and other factors, making it a more accurate representation of our progress in reducing the cost of international transfers over time.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are based on current expectations and projections about future events. These statements may include, without limitation, any statements preceded by, followed by or including words such as “target”, “believe”, “expect”, “aim”, “intend”, “may”, “anticipate”, “estimate”, “plan”, “project”, “will”, “can have”, “likely”, “should”, “would”, “could” and any other words and terms of similar meaning or the negative thereof. These forward-looking statements are subject to risks, uncertainties and assumptions about Wise and its subsidiaries. In light of these risks, uncertainties and assumptions, the events in the forward-looking statements may not occur. Past performance cannot be relied upon as a guide to future performance and should not be taken as a representation that trends or activities underlying past performance will continue in the future. No representation or warranty is made or will be made that any forward-looking statement will come to pass. The forward-looking statements in this report speak only as at the date of this report.

Wise expressly disclaims any obligation or undertaking to update, review or revise any forward-looking statements contained in this report and disclaims any obligation to update its view of any risks or uncertainties described herein or to publicly announce the results of any revisions to the forward-looking statements made in this report, whether as a result of new information, future developments or otherwise, except as required by law

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.