How to Open a Tide Business Account

Discover how to open a Tide Business Account in the UK. We'll cover requirements, step-by-step and account features.

Run an ecommerce business? If you accept online payments from your customers, you’re going to need to know about payment processing APIs.

API payment processing is widely used by UK businesses to make and receive payments. It automates payment processes, saving a huge amount of time when paying invoices and improving the customer experience when accepting online card payments.

Without payment APIs, the world of online shopping as we know it would be quite different. They’re also transforming accounts payable processes for businesses of all kinds.

In this guide, we’ll run through all of the essentials you need to know about automating payments through API.

We’ll also show you how you can use the powerful Wise Business API to automate payments.

💡Learn more about Wise Business

An Application Programming Interface (API) is an intermediary which allows two applications (such as software or apps) to communicate with each other. It does this through a set of predetermined rules, protocols and definitions.

This opens the door for integration, where multiple applications can be used together - but the business can manage everything all in one place.

An API for payment processing connects together all of the entities involved in a particular transaction. For example, the ecommerce platform, payment processor and gateway. By enabling all of these entities to communicate and work together, this adds payment processing capabilities to almost any existing software.

APIs can be used for pay-ins (i.e. accepting customer payments) and for payouts (i.e. sending payments, such as to pay bills and invoices).

Payment APIs can also be customised in a variety of different ways. This means you can create unique payment setups (i.e. for credit or debit card payment processing) that fits the exact needs of your business.

Online payment processing APIs act as the vital link between an application and a web server. They connect your ecommerce website with the payment processor used in the checkout process, linking all parts of the chain together. These are known as payment gateway APIs, which we’ll look at in more detail shortly.

Payment APIs can also be used by businesses to make B2B payments. They can handle payments in all forms, such as bank transfers, debit/credit cards and gateways such as PayPal, Google Pay and Apple Pay. When used for this purpose, they’re generally known as Payout APIs.

You can also find global payment APIs. These are especially designed for companies which do business internationally and need to overcome the many complications associated with global payments.

To help you understand a little more about how they work, here’s how a typical payment gateway API process would look:¹

Payment gateway APIs are commonly used in the ecommerce world. In fact, many online retailers simply wouldn’t be able to function without them.

As we’ve already looked at, these APIs facilitate the seamless processing of payments between all parties - the application (i.e. the ecommerce site), the gateway and the processor. It enables all entities to talk to each other, so that quite complicated processes such as verification and fraud checks can all be completed in a matter of seconds.

Without APIs, each ecommerce business would need to build its own custom system, or use an off-the-shelf solution that might not quite fit their needs.

Global payment APIs are essential for businesses which need to pay clients and suppliers all over the world.

Making international payments in multiple currencies can be complicated and time-consuming. There are also compliance, tax and reporting issues to overcome. But automation can make many aspects of this process significantly quicker and easier.

Global payment APIs can be used to process and approve invoices. They can execute payments in a range of payment types and currencies, as well as managing a full schedule of future-dated and recurring payments.

APIs can also link together payment systems and accounting systems, which can help enormously with record-keeping, compliance and transparency.

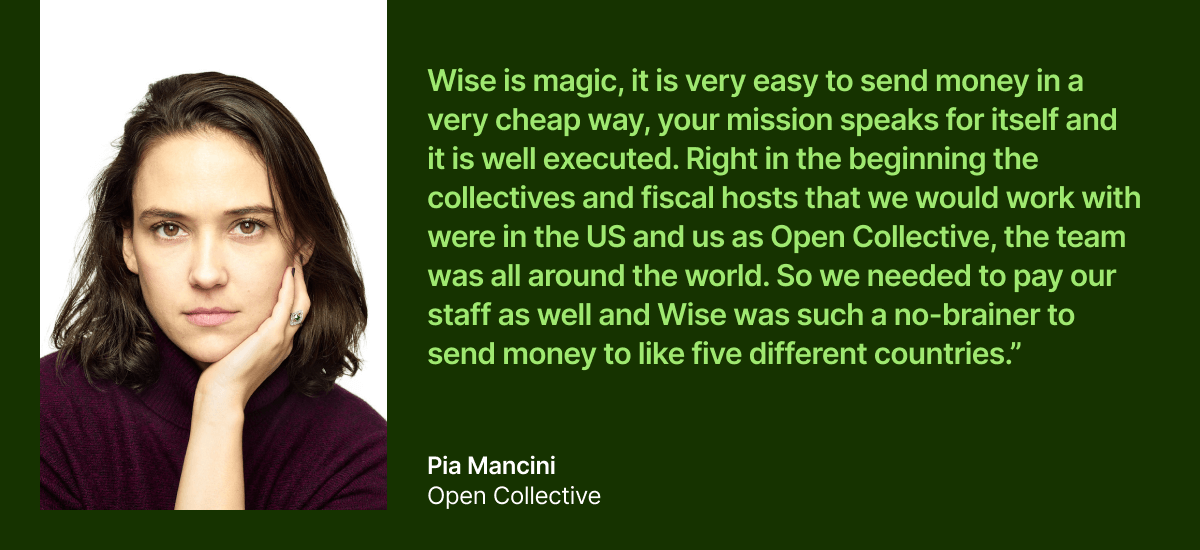

One great example of global payment APIs in action is the Wise Business API. This powerful tool can handle everything from batch payments and invoices to running payroll, all with minimal human interaction.

💡 Read Open Collective's complete case study

Another time and resource-hungry process that businesses face every day is payroll. It can be even more complicated if the organisation employs remote workers or teams spread across geographical locations.

Payroll processing APIs can be used to automate the process. The nature of payroll means that automation is relatively straightforward to do, as it is repeatable and not much of the core data changes from month-to-month.

APIs can help to take the manual, repetitive work out of payroll processing, such as data entry and individual scheduling of large numbers of payments. And for complicated processes such as global payroll, it can improve efficiency and cut the risk of human error.

Here’s an example of how solutions such as the Wise Business API have been used to streamline and simplify international payroll.

💡 Read Povio's complete case study

API payment processing is popular among UK businesses for a good reason. In fact, there are a number of persuasive reasons to make use of this time-saving, cost-cutting technology. We’ll explore just a few of these below.

Whether you’re paying invoices or accepting payments on your website, faster payment processing offers benefits all-round. It can improve relationships with B2B clients, help you avoid the risk (and potential penalties) of late payments and meet customer expectations. You can also capture more sales when payment processing is quicker.

Today’s ecommerce customers have high demands when it comes to their online shopping and payment experience. They expect it to be both seamless and quick. Payment gateway APIs can deliver the experience that customers demand, which can help with everything from sales and revenue to customer loyalty.

With manual payment processing, there’s always a chance that a wrong figure could be entered or a key deadline missed. Automation through APIs minimises this risk of human error and ensures that payment processing is more accurate from start to finish.

Payment APIs can also facilitate the integration of accounting tools and systems. This can improve the quality, accuracy and efficiency of accounting and reporting.

One of the main purposes of payment APIs is to automate manual, repetitive tasks. For example, tasks such as data entry, invoice processing and other admin work.

This can save organisations an enormous amount of time, which can be spent on more value-adding work. It boosts productivity and efficiency, reduces staff costs and enables smaller businesses to do more with less.

Does your business trade internationally? If so, you could be facing extra challenges and obstacles in processing payments, as there are multiple currencies involved.

Wise Business can make it much easier. Open a Wise Business account and you can manage finances in 40+ currencies, all in one place. You can make batch payments to clients and suppliers all over the world in just a few clicks, and manage expenses easily using Wise Business cards.

But one of the best features of Wise Business has to be its powerful API. You can create and manage API tokens to automate payments and recurring transfers. It’s also a great tool for running payroll.

With the Wise Business API, you can save time and money with user-friendly automation tools that can be customised to suit your exact needs.

Want to see it in action? Take a look at this real-life example of Wise Business powering payment automation for Open Collective.

Get started with Wise Business 🚀

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

And that’s it - all the essentials you need to know about payment processing APIs. We’ve looked at the different types, namely payout and pay-in APIs, along with how they work.

And of course, we’ve run through the many benefits. This includes saving time, improving the customer experience, boosting productivity and ensuring greater levels of accuracy in payments, accounting and reporting.

After reading this, you should be ready to take your first steps into the world of payment automation with APIs.

Sources used for this article:

Sources checked on 30-Nov-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover how to open a Tide Business Account in the UK. We'll cover requirements, step-by-step and account features.

Read our comprehensive guide to the Revolut Business debit card, covering everything you need to know.

Read our review of the Tide Business savings account, including interest rates, limits and how to open an account.

Read our review of the Revolut Business savings account, including interest rates, limits, FSCS protection and how to open an account.

Check our comparison between Airwallex vs Stripe, We'll cover features, costs and reviews for both providers.

Check out our overview from Tide Business Loan, covering how it works, interest rate, fees and more.