4 steps to consolidate your business finances with accounting software

As a business owner it’s crucial that you keep on top of your company’s financial health at all times, including profit and loss, balance and cash flow. This...

If you run your own business, then knowing how to calculate your profits will be second nature. However, one of the best indicators for whether your business is doing well is by working out margin rations, or profitability ratios as they are commonly known.

In this guide, we’ll give you a brief overview of various types of profitability ratios and focus in depth on how to calculate your operating profit margin. We’ll explain what it can tell you about the health of your business, outline how it can impact your business’ performance and touch on how a Wise Business account could potentially help you save on operational costs when dealing with multiple currencies.

A profitability ratio can be defined as a financial metric¹ used by a company in order to measure and analyse its financial health. As well as showing how much profit and value a business is generating, they will also provide a clear breakdown of a company’s assets. A high profitability ratio indicates that a company is doing well financially. They are also a valuable tool for comparing a company to its competitors or with previous tax years.

The main types of profitability ratios are:

The definition of gross profit margin² is the percentage of revenue that your business keeps once you’ve deducted your direct expenses.

This describes the percentage of income remaining once you’ve deducted the operational costs involved in the day-to-day running of your business³.

The definition of net profit margin is the percentage of revenue once all direct costs, operating expenses, interest payments and taxes have been deducted⁴.

As previously mentioned, your operating profit margin will show how much income you have left over once you’ve deducted your operational costs for the day-to-day running or operation of your business. By their nature, these are variable and include costs such as rent, insurance, marketing, office supplies, travel costs, accountancy fees and office supplies.

Your operating profit is referred to as your earnings before interest and taxes or EBIT for short. While gross profit margin only considers the direct costs associated with producing a product or service (like material, shipping - also known as the Costs of Goods Sold or COGS), the operating margin includes the additional costs involved in running the overall business.

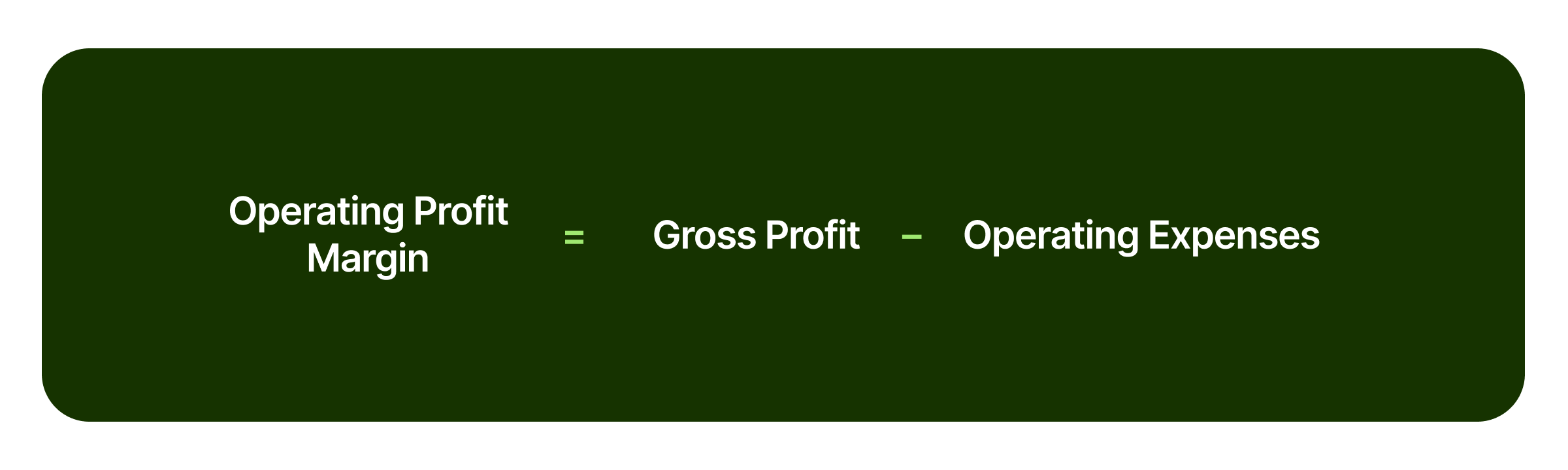

It’s important to understand how Operating Profit is calculated in order to find out the margin. Operating Profit is the net amount after operating expenses has been deducted from Gross Profit (Revenue - Cost of Goods Sold)

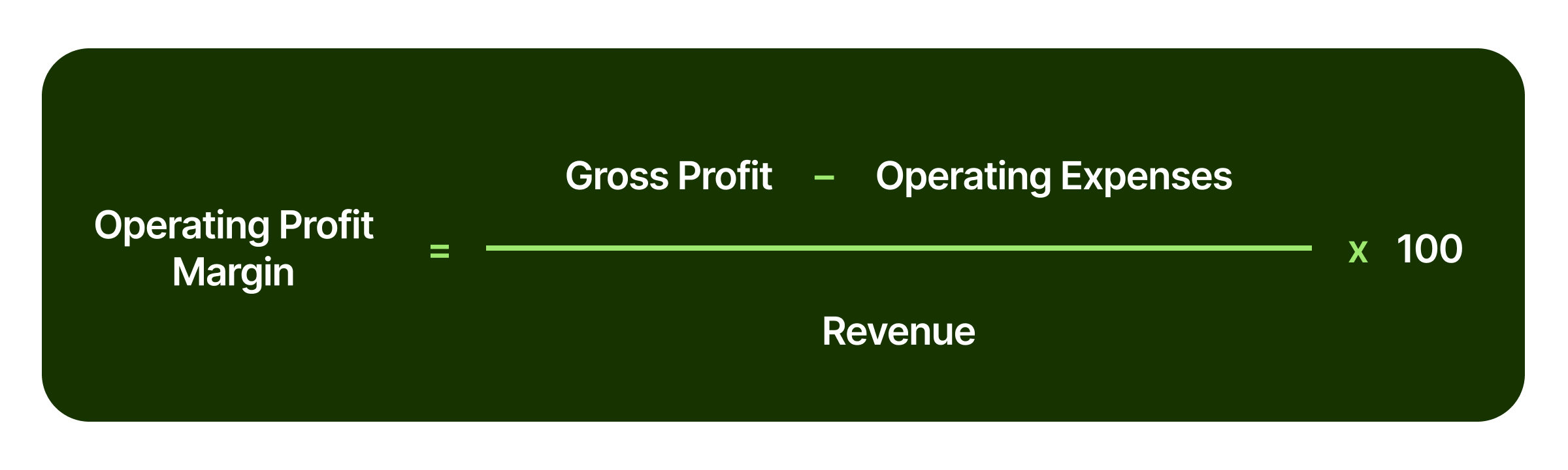

Here's the formula:

Remember, the operating expenses are made up of costs over which the business has more control. These include salaries, rent, depreciation, selling and marketing expenses.

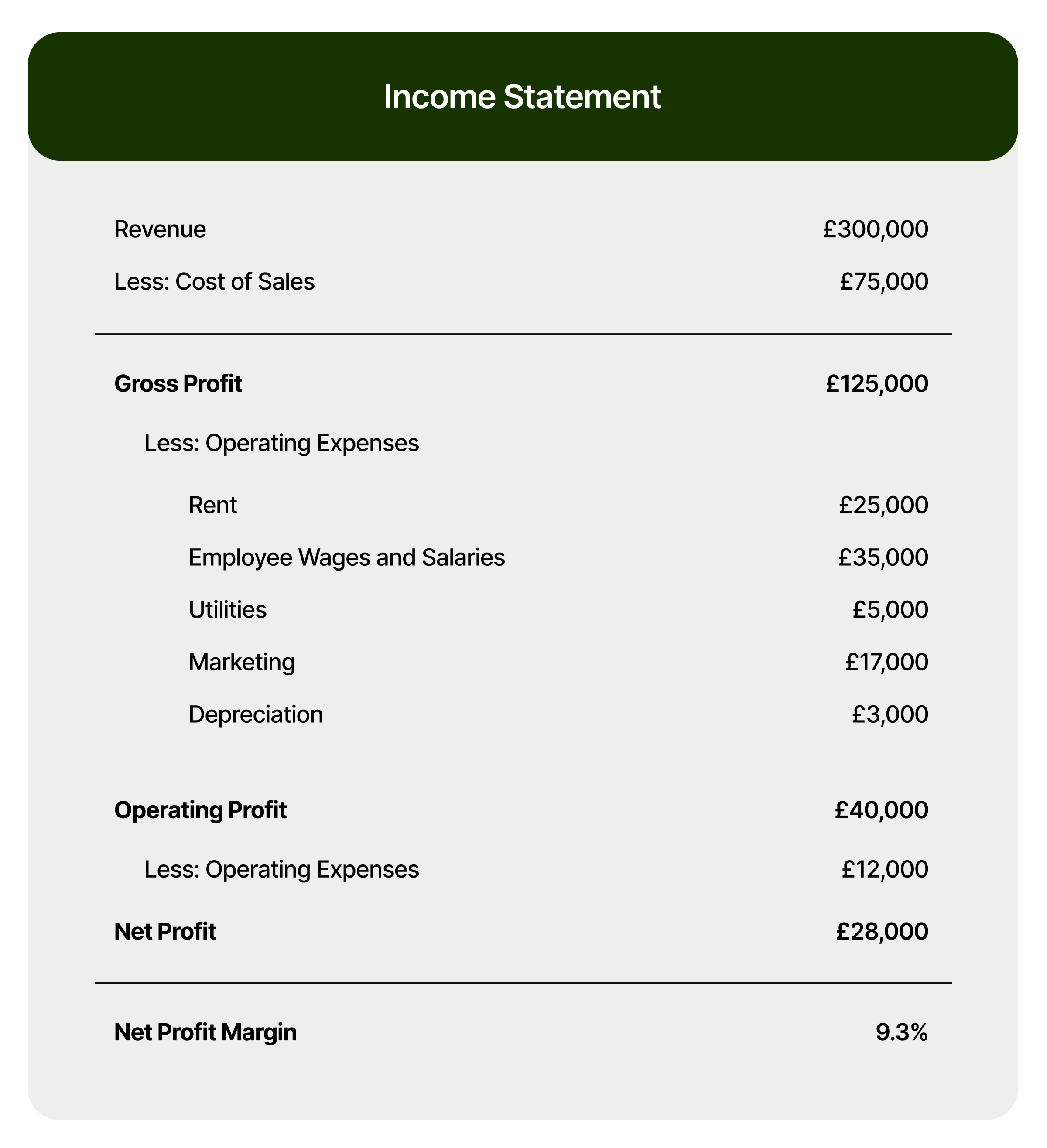

Consider the following components of an Income Statement:

Now let’s apply the formulas we’ve shown above:

Operating Expenses = 25,000 + 35,000 + 5,000 + 17,000 + 3,000 = 85,000

Operating profit = 125,000 – 85,000 = 40,000

Operating profit margin = 40,000/300,000 x 100 = 13.33%

As well as revealing some key insights about your company, your operating profit margin will also indicate how much operating cost goes into per unit of revenue earned. Business owners and managers can analyse this figure and decide whether these costs need to be more tightly controlled in order to improve profitability.

Operating profit margin also determines the ability of a company to meet its interest payments. It can also help management decide whether to deploy more leverage to enhance the return to its shareholders. Operating profit is also compared to interest payments to understand the creditworthiness of a company.

The definition of a good profit margin depends on the type of industry in which a company operates⁵.

Generally, a 10% operating profit margin is considered an average performance, and a 20% margin is excellent. It's also important to pay attention to the level of interest payments from a company's debt. Two companies with the same operating profit and margin may exhibit differences in their profitability performance if their level of debt is different.

It's also important to keep in mind that tax isn’t taken into consideration when calculating while making this assumption especially for companies that are operating in different countries or jurisdictions where tax laws might be different. The tax rate may also vary depending on the industry, and the margin would have to be tweaked based on the company’s industry.

If your business deals with overseas contractors or buys and sells from different countries, you might want to find a way to reduce the overall international payment cost. These transactions are usually expensive using traditional methods like banks or PayPal and can start to eat into your operating profit margin.

Use Wise Business to manage your business finances easily and with low fees.

Did you know, with Wise you can hold and exchange 40+ currencies, get local account details in major currencies like GBP and EUR to receive payments from customers? Accounts also offer linked debit and expense cards, multi-user access, batch payments, cloud accounting integrations and more, with no ongoing fees and no minimum balance requirement.

To help businesses keep hold of more of their profits while trading internationally, Wise uses the mid-market exchange rate for currency conversion, with fair and transparent fees. This keeps costs down for business trading across borders - and lets you concentrate on what matters - growing your business.

Check out how one business is making the most of Wise Business in this Open Collective case study.

Ready to learn more about how to open a Wise business account in the UK? Here’s a quick overview:

Download the Wise app or head to the Wise desktop site

Tap Register and follow the prompts to apply for a business account

Add your personal and contact information

Upload the documents needed which are detailed online and in this Wise Business account requirements guide

Pay the one time fee to register your account and get a linked payment card if you need one

Once your account is verified you can start transacting - your account will be live in the Wise app, your physical card will be posted to you, and you can get a digital card right away for mobile spending

Get started with Wise Business 🚀

The Operating Profit Margin is a better indicator of the overall performance of a business because it gives a more clear view for where and how costs that are within control, can be managed.

Sources used in this article

Sources last checked Apr 18, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

As a business owner it’s crucial that you keep on top of your company’s financial health at all times, including profit and loss, balance and cash flow. This...

Starting a consulting business has never been more accessible or more exciting, offering the opportunity to work flexibly from home or abroad, with clients...

Keeping track of your income, expenses and cash flow isn’t the most exciting aspect of being a sole trader - but it’s essential to the health of your...

Running a business is rewarding - but it can also feel pretty hectic. When you’re starting out, and particularly if you’re looking to scale and expand...

Getting paid is a key moment for your business - it means that your product fit and marketing strategy has hit the mark and customers are happy to exchange...

Wise Platform has teamed up with T2P, a leading payment solution provider, as our first partner in Thailand.