HSBC Kinetic vs HSBC Business Account: Full Comparison

A complete head to head comparison for two HSBC account options for business: HSBC Kinetic vs Business Account, discover which is better for you.

If you’re looking for a flexible way to manage your business finances across borders, Wise may be a good fit, with low cost international accounts, cards and money transfers. However, before you pick an account to use for your business it’s prudent to do a bit of research. So - is Wise legit?

The good news is that Wise is regulated for the services it offers, and caters to millions of personal customers around the world - and over 300,000 business customers every quarter. Plus, Wise gets a 4.4 out of 5 Excellent star rating, from over 186,000 reviews on Trustpilot¹, with over 90% of reviews giving Wise a solid 4 or 5 star rating, praising the simple and efficient tools on offer.

Join us as we look at Wise security, how services are regulated, and how Wise ensures your business account is protected.

| 📝 Table of contents: |

|---|

Wondering: is Wise money transfer safe? Or: is a Wise account safe? Let’s dive right into how Wise keeps business and personal customers and their money safe.

Wise is licensed and regulated in the UK and other countries and regions where services are provided. This means Wise money transfers, and Wise accounts - as well as other products like the Wise international debit or expense card - are subject to local and global rules designed to keep customers’ money and accounts secure.

Aside from these regulatory requirements, Wise has been built with customer safety in mind and has automatic and manual protections running 24/7 to keep customers safe.

We’ll break down the steps Wise takes to keep accounts and funds safe, one by one, next.

One important thing to note is that Wise is not a bank, and as such is not part of the FSCS (Financial Services Compensation Scheme). Instead, as part of the conditions of maintaining a financial service licence in the UK and internationally, Wise must follow a different set of rules to keep customer money safe, known as safeguarding. We’ll explore how that works and how it’s different to FSCS in a moment.

Wise is not covered by FSCS protection, but instead, as an Electronic Money Institution in the UK, Wise protects customer funds through safeguarding.

This means that Wise holds all customer deposits in either²:

- Cash deposits with top tier financial institutions - like Barclays and Citibank

- Secure liquid deposits - like government bonds in the UK, US or EU

Safeguarding customer funds does a couple of things. Firstly, this means your money is not held with Wise’s own working capital, so it can’t be used for the day to day running of the Wise business.

And secondly, by holding funds in both trusted global banks and liquid assets, Wise diversifies risk and increases liquidity so funds are available whenever customers may need them.

If you need to send a payment overseas - to pay suppliers, contractors or staff for example - Wise Business can offer easy transfers to 160+ countries, with the mid-market exchange rate and low, transparent fees.

Wise payments are fast - or even instant³ - and with Wise’s batch payment tool you can even pay up to 1,000 people at one time, in a range of currencies - cutting down admin time significantly.

Wise money transfers are secure and safe to use. Wise will not usually need to hold customer funds when processing a transfer. However, if there is a need to hold funds temporarily - for example, as verification checks take place - your money is safeguarded.

You’ll be able to track your payment through the Wise app at any time. And all Wise accounts are secured with 2-factor authentication, with dedicated anti-fraud teams on hand in the background to spot and prevent suspicious activity.

Wise Business accounts are safe - even if you’re sending or holding a large amount of money.⁴ Business and enterprise level customers frequently need to send and manage high value payments - so Wise has a dedicated support team on hand to ensure the process goes smoothly. In fact, you could even get a discounted fee if you’re sending payments of over 100,000 GBP or the equivalent in other currencies.⁵

Wise Business accounts are safe, with a range of automatic and manual features which keep customers and their money secure.

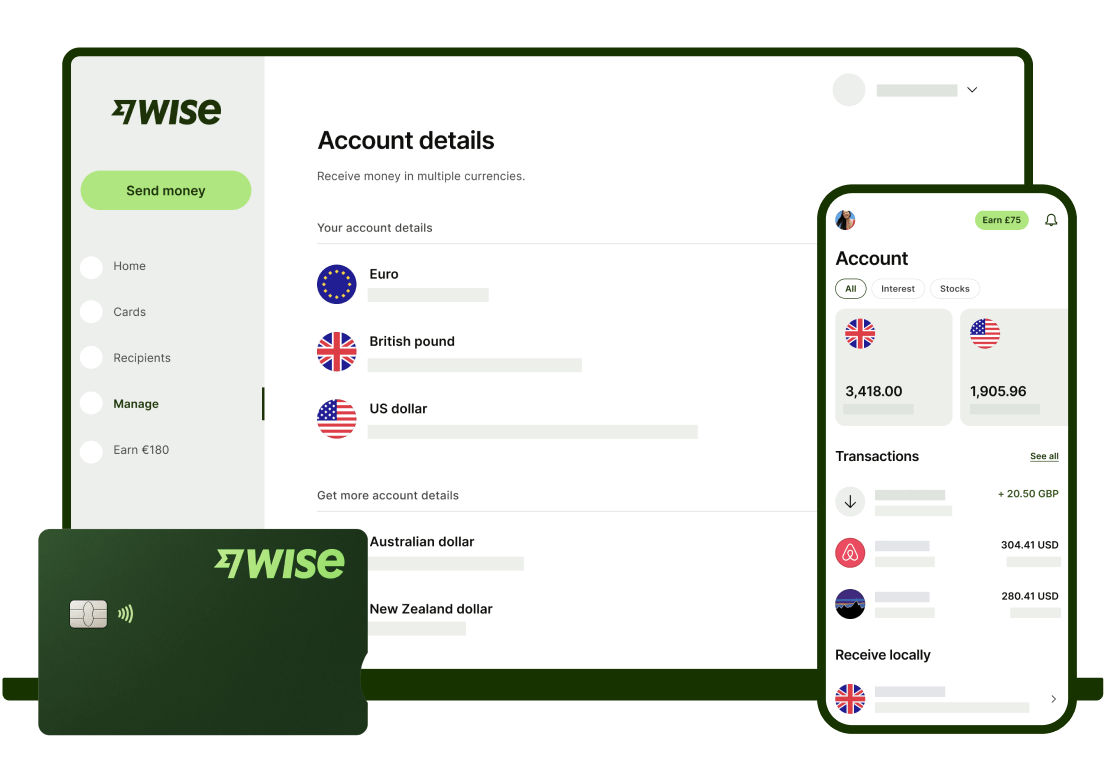

Before you can create a Wise Business account you’ll complete verification checks which are a legal requirement, and part of ensuring accounts can’t be used for illegal or fraudulent activities. Once you have your Wise Business account set up, you can add 2- factor authentication⁶ to keep your details and transactions secure. You’ll also be able to review your account, transactions and balance - across over 40+ currencies - at a glance in the Wise app.

Wise Business accounts also come with a few other neat features which can both increase security and make it easier to manage your company finances day to day. For example, you’ll be able to get a Wise Business card for yourself, and Wise expense cards for team members, and set spending limits as needed. Set up instant transaction alerts in the Wise app if you want to get live spending updates in real time, and freeze and unfreeze cards as you need to.

You can also add team members to your Wise account, and manage user permissions to make sure everyone has the tools they need to do their jobs without any risk to your business. Employees can view their own transactions, while payers can be authorised to set up transfers, and account admins are able to add new users, manage permissions and more.⁷

Yes. You can hold a balance with Wise Business in 40+ different currencies. And as Wise is regulated by authorities all over the world, you’ll always know your money is safe, no matter which currency you hold it in.

Wise Business cards come with in-built features to help keep your account secure. Of course, you’ll still need to take standard safety precautions like keeping your card PIN secret, and keeping an eye out for unfamiliar transactions. However, generally, the Wise Business card is safe to use, thanks to these security features:

If you’re concerned about a payment on your Wise card which you think may be fraud you’ll be able to freeze the card and report the issue to Wise directly. You’ll get a response within 1 business day, and can discuss with the Wise team what your next steps should be.¹¹

If you’re looking for a secure, convenient and low-cost way to manage your business finances, check out the Wise Business account.

You can open your account online or in the Wise app, and get everything you need to grow your business across borders - including the option to hold a balance in 40+ currencies, international debit and expense cards, and local bank details to get paid in 8+ currencies.

Wise currency conversion always uses the mid-market exchange rate with no sneaky exchange rate markups or hidden fees - just low, transparent charges based on the services you need.¹² That can keep down costs. And because Wise Business accounts are fully licensed and regulated, and safe to use, you’ll also get peace of mind, no matter which currency you need to hold, send or spend, so you can focus on delighting your customers and growing your company.

Besides all that you can get to know Wise Business company formation solution, where you can create a limited company in the UK and open a Wise Business multi-currency account in one go.

Manage your international finances

safely with Wise Business

So there you have it. Keeping your business - and your profits - safe is a priority for any company owner. With Wise Business you’ll know you’re getting an account and services which are overseen and regulated all over the world, with in-built security features to help keep your money safe, too. See how Wise Business can help you connect with more customers around the world - safely - today.

Sources:

Sources last checked March 21, 2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A complete head to head comparison for two HSBC account options for business: HSBC Kinetic vs Business Account, discover which is better for you.

Check a HSBC vs Barclays business banking head to head comparison for business in the UK. Rundown on fees, features and account options.

Doing business overseas? Discover the best multi-currency accounts in the UK to receive and send money abroad.

A comparison of Wise Business vs. Revolut Business, covering accounts, features, fees and more.

A guide to the Starling sole trader account vs. business account, comparing the two on features, fees and eligibility.

A helpful guide on how to close a Revolut Business account, including a step-by-step guide.