4 steps to consolidate your business finances with accounting software

As a business owner it’s crucial that you keep on top of your company’s financial health at all times, including profit and loss, balance and cash flow. This...

Germany is one of the UK’s most important trading partners. If you’re thinking of importing from Germany to the UK for your business, you’ll need to learn about the process and requirements involved. This guide walks through how to import from Germany, how to get an import licence in the UK if you need one, and some of the import charges from Germany to UK you’ll need to know about.

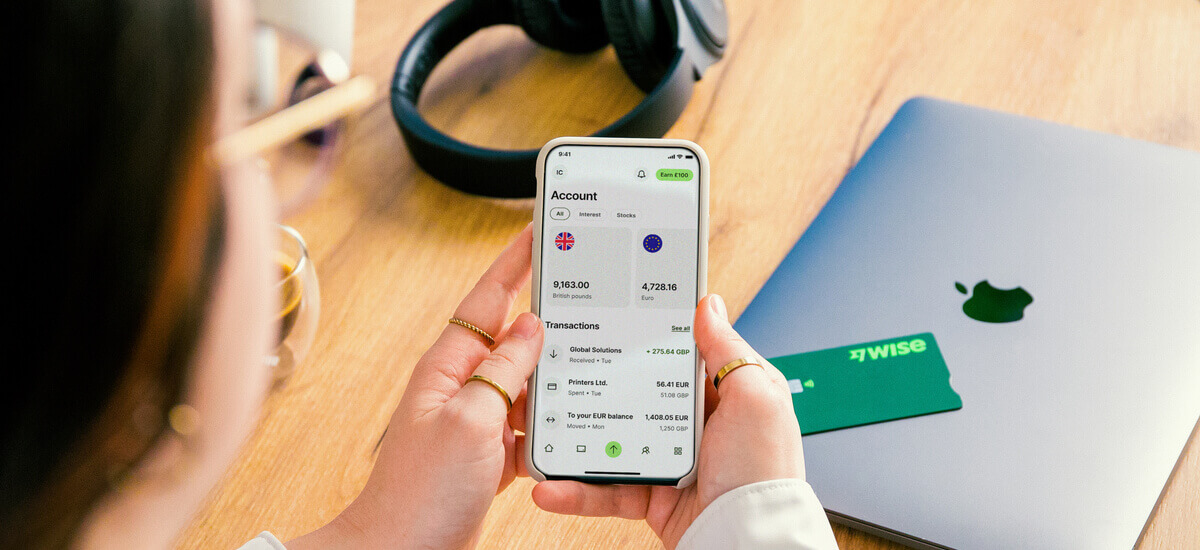

We’ll also touch on Wise Business as a great option when paying German suppliers from the UK, with the mid-market exchange rate for EUR transfers, and low, transparent fees.

💡 Learn more about Wise Business

| 📝 Table of contents: |

|---|

If you’re considering importing goods from Germany to the UK there are a few important things to consider. You’ll need to check your business is ready to import from Germany to the UK, including getting any required import licence, double checking the rules for tax and duty at home and in Germany, and more.

This guide walks through the basics of importing from Germany to the UK to get you started - if you’re not sure how the rules apply in your specific situation, get professional advice to stay on the right side of the law and to avoid any unnecessary hassle or cost.

Whether or not you need a licence to import goods to the UK depends on what you’re importing. There are restrictions and rules on importing some items, such as animals, medicines, dangerous materials, waste and weapons. You may need a specific licence or a certificate to cover the import.

Generally the process of importing goods from Germany to the UK will cover the following steps1 - we’ll look at some of the key processes involved in more detail later:

- Apply for an Economic Operators Registration and Identification number (EORI number)²

- Check the business you’re buying from can export to the UK

- Get the commodity code for your goods

- Work out the value of your goods for duty and VAT purposes

- Check if you need a licence or certificate for your goods

- Check the customs duty rules based on the import type

- Check labelling and marketing rules for items like food and manufactured goods

- Complete the customs declaration and ship your goods

- Claim a VAT refund

Your EORI number must begin with GB if you’re importing items to England, Wales or Scotland. If you already have an EORI number which begins with different letters you’ll need to apply for a new one - a process that can be completed online.

You can also learn more about how to get an import licence in the UK and get pointers on how to start an export business in the UK in our handy guides.

Germany is one of the UK’s largest trading partners, accounting for over 8% of total trade in 2023³. Cars and other vehicles were one of the most commonly imported items from Germany, with medicines, pharmaceuticals and smaller electronic items also in the top 5.

The most common way to import goods from Germany to the UK is overland. Moving goods within the EU is pretty frictionless, so loading up a container in Germany and having it moved to the UK’s border by truck can be an easy option. Freight forwarders can handle this process on your behalf, preparing the customs declarations and paperwork, booking a ferry and ensuring everything is lined up in advance.

To find the best way to import your goods from Germany to the UK you’ll need to compare some different supplier and shipping options, looking at cost and speed.

You may need to pay import tax on the items you import from Germany to the UK. Whether or not you pay tax will depend on the value of the shipment, and exactly what it is. Shipping agents, freight forwarders and other third party providers can assist with calculating import taxes if you’re unsure of how the process works.

The basic process to calculate import taxes starts with finding the commodity code for the items in question⁴. This code is linked to what the item is, how it’s used, what it’s made from and how it was produced. Items with different commodity codes have different import tax arrangements - so once you’ve checked the tax that applies to your item you can calculate how much is owed based on the percentage tax bracket your item falls into.

| Read more about importing charges from Germany to the UK |

|---|

Import VAT is normally charged on all items imported to the UK which are being brought in for commercial purposes - there are some exceptions on items being shipped as low value gifts. Import VAT is usually 20%, although there are some items which have different rates so you’ll need to double check the detail for your specific products⁵.

Import duty is set as a percentage rate based on the commodity code for the items you’re shipping into the UK. This can vary based on the type of item and whether or not there’s a specific trading agreement covering the import of that item.

Let’s walk through the most important considerations in the step-by-step process of importing goods from Germany to the UK. If you’re not sure how to import from Germany in your specific case you can get lots of help from third party agents and freight forwarders who will be able to advise you for a fee.

Do some research to find the right supplier in Germany for the items you want to import. Some businesses will need to make export declarations in order to be able to sell items for export, and depending on the goods involved the business you’re buying from may also need their own licence or certificates.

A great way of finding suppliers for a specific product or industry is to attend trade fairs in the country you intend to buy from. This means heading to Germany, and visiting a trade fair where you can check the products first handed, get to know suppliers in person and even negotiate better deals. To discover German trade fairs you can check the Trade Fairs Dates database.

If you decide to visit a trade fair in Germany, Wise Business debit card can be a great way to spend in Euros with ease.

You can pay in EUR with your Wise Business card even if you don't have a balance for the currency on your multi-currency account. Wise smart technology will convert your spending automatically to GBP with the mid-market exchange rate. What is even better? You earn 0.5% cashback on your purchases.

Get started with Wise Business 🚀

It’s important to do due diligence checks here, getting samples of goods, agreeing well in advance on payment terms, timings and costs, and clarifying the process that will be followed for importing your items.

As with any business deal you’ll need to negotiate the terms of your import purchase. Be clear on what you’ll pay, when, and in which currency - and remember to factor in considerations such as shipping costs. It’s common for international business agreements to refer to incoterms⁶ to cover commercial practices and to ensure understanding when dealing with businesses overseas. If you’re unsure about how to draw up an import agreement it’s useful to get professional advice to make sure everything is in order.

Paying for your import in EUR? Choose Wise Business when paying for goods in euros, and your pounds will be converted using the mid-market exchange rate with low fees from 0.42%. This can cut the overall costs of currency conversion - and mean you make more in profit when you resell your imported items.

Get started with Wise Business 🚀

For many items, the most common way to transport goods from Germany to the UK is overland, shipping to the UK’s sea border and then using a ferry. Routes from Northern Germany to the UK can take just a day or two, but shipping from the south is likely to take a little longer - 3 or 4 days on average.

It’s common to have a freight forwarder or customs agent complete the UK customs processes, to save you time and to make sure you have all the paperwork needed to import to the UK hassle free. The documents needed can vary depending on the type of items you’re importing, and can include:

- A bill of lading

- A commercial invoice

- A packing list

- A certification of origin

- Import licence

You’ll also need your EORI number starting with GB to import to England, Scotland or Wales.

If you have a UK business importing from Germany, Wise Business can help.

Wise offers business accounts which can hold and exchange ` currencies, and which come with local bank details to get paid by others in major currencies like GBP and EUR. That makes it easier to receive payments from customers - and also lets you seamlessly pay suppliers based in Germany and beyond when importing to the UK.

Convert from GBP to EUR and dozens of other currencies with the mid-market exchange rate and transparent fees when sending international payments. There are no hidden costs or hiked up rates, and Wise Business transfers can arrive quickly or even instantly so your supplier won’t be kept waiting when it’s time to pay.

Get started with Wise Business 🚀

Use this guide to get started with importing from Germany to the UK - and remember to check out Wise Business for easy ways to pay in euros, using the mid-market exchange rate and low, transparent fees.

Sources used in this article:

Sources last checked March 25, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

As a business owner it’s crucial that you keep on top of your company’s financial health at all times, including profit and loss, balance and cash flow. This...

Running a business is rewarding - but it can also feel pretty hectic. When you’re starting out, and particularly if you’re looking to scale and expand...

Check out our guide on Canada tax codes. Get to grips with tax codes by province, federal income tax rates in Canada to help with international employees.

Looking to scale your business in Scotland? Check out this guide to business grants in Scotland from start up funding to government business grants and more.

Seeking funding for your business? This guide signposts what grants are available for small businesses in the UK and tips to help ensure application success.

Looking to scale with a business grant? This guide outlines opportunities for business grants in Wales - from start up funding to Welsh government grants.