Importing from Spain to the UK: Complete Business Guide

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

When you work for yourself, it’s a good idea to keep your business expenses separate from your personal spend.

There are two main reasons for this. Keeping business expenses apart from personal costs makes them clearer and easier to manage. Plus, you know exactly what is coming in and out of your business.

Using a credit card for business expenses is one way of making sure you deal with business expenses separately. In this article you’ll see the best credit cards for business expenses. We’ll also explore how you can manage your employees’ expenses using Wise Business debit cards.

Learn more about Wise Business 💡

You may find it easy to get a personal credit card. There are also some great deals available including interest free periods. However, using personal credit card for business expenses UK isn’t a good idea for the following reasons¹:

It becomes more difficult to track tax-deductible business expenses

You can’t build your business credit rating with a personal credit card

If your business is a limited company, keeping your business and personal dealings separate is essential to maintain this legal protection

Expense cards are a type of business credit or debit card. These cards give you and your employees greater flexibility when making business purchases². As a business owner or manager you can control spending whilst still enabling employees to cover their work expenses. Using business expense cards gives you access to tools such as:

Setting spending limits.

Monitoring spending for each card.

Linking cards with your business accounting tools.

Reduces admin with less need for paper-based expense claims

There are three types of card you can use for business expenses. These three types are prepaid cards that you can top up with a set amount, credit cards with an approved credit limit, and debit cards with funds coming from your business bank account.

The table below shows the comparison between these cards.

| Prepaid expense cards | Expense credit cards | Expense debit cards |

|---|---|---|

| Spending comes from a prepaid balance on the card that you can top up | Spending comes from an agreed credit limit | Spending comes from your business bank account balance or your agreed overdraft |

| Some fees may apply | Fees are likely to apply | No fees apply unless you exceed the amount in your business bank account or your agreed overdraft limit |

| Simple application process with no credit checks | Business credit cards can be hard to get. The application process includes a credit check | Comes with your business bank account |

| Does not build your business credit rating | Builds your credit rating but can be damaging if you don’t make payments on time | Does not build your business credit rating |

| Expenses can be controlled | There’s a spending limit but there’s a danger of creating debt if you don’t make payments on time | There’s a spending limit but charges can be expensive if overspends happen |

Using a credit card for business expenses may be a good move for your business if you manage its use in the right way. However, credit cards may not always be the best choice, so taking time to make the right choice is important. You’ll find some points to consider to help you decide

| Why you may decide to use a business credit card |

|---|

| If your business doesn’t have much of a credit history, using a credit card responsibly can help build one |

| Encouraging employees to use a business credit card for expenses keeps all expenses in one place instead of separate expense claims |

| Having a rolling line of credit with several weeks before interest is charged makes it easier to budget |

| A business credit card helps you separate personal from business finances |

| Important considerations |

|---|

| Debts can build up if payments are made on time |

| You risk damaging your credit score if payments are late, making it more difficult to get funding for your business in future |

| If a card has an annual fee attached, your usage may not justify the fee involved |

If you’re looking for an expense card for employees,Wise Employee Expense Cards are simple to use and help you control the expenses for your business. The features of these cards include:

Transparent fee of £3 per expense card for employees.

The facility to pre-set spending limits and control access to cards.

Reduced costs for international transactions as you get the mid-market exchange rate when you pay bills or expenses in foreign currencies.

The ability to pay in-store or online in more than 200 countries using 40+ currencies.

0,5% cashback) on purchases.

Discover how Wise can help manage business expenses 💰

In the list of best credit cards for business expenses below, you’ll find cards to consider based on points such as annual percentage rate (APR), interest rates, withdrawal fees, foreign transaction fees, and cashback or rewards.

You can use the Cashplus credit card to make purchases, cash payments and card withdrawals at millions of locations worldwide. You can currently only apply if you’ve received either an email or postal invitation from Cashplus to apply.

Whether you are approved or not will depend on factors such as your credit history and financial circumstances. Credit checks will be run before a decision is made, which will result in a hard search appearing on your credit record.

| Features⁴ | Fees⁴ |

|---|---|

| Services | Cashplus is regulated by the Financial Conduct Authority (FCA). Services that come with this card include:

|

| Annual percentage rate (APR) | Representative APR 29.9% (variable) dependent on circumstances |

| Interest rates | Interest rates as low as 19.9% variable on purchases (dependent on circumstances) |

| ATM Withdrawals fees | £3.00 |

| Foreign currency transactions | 2.99% |

| Cashback or rewards | 1% cashback |

To apply for this credit card you must have an active business registered with Companies House as a private limited company (Ltd) or limited liability partnership (LLP). You must also have no unsatisfied CCJs against you in the last 12 months. Your business turnover must be at least £2,000 per month.

The basic account has no annual fee and gives you control of your business expenses in real time. The Business Rewards account costs £99 per year and includes bonus points and additional redemption options.

| Features⁵ | Fees⁵ |

|---|---|

| Services | Capital On Tap is authorised and regulated by the Financial Conduct Authority (FCA). Services that come with this card include:

|

| Annual percentage rate (APR) | Representative APR 29.9% (variable) dependent on circumstances |

| Interest rates | Interest rates as low as 15.5% variable (dependent on circumstances) |

| ATM Withdrawals fees | Free |

| Foreign currency transactions | Free |

| Cashback or rewards | 1% cashback Exclusive offers like savings at Dropbox, Slack and Superscript |

Barclays is a long-standing and trusted name in UK banking. Choose Barclays, and The Select Cashback credit card is one of three credit cards you can apply for. It gives you a fast and convenient way to manage business expenses. It’s also a good choice if you trade overseas as benefits include FX savings and cashback on travel and trade.

Other credit cards you can choose from at Barclays are the Premium Plus credit card and the Select charge card.

| Features⁶ | Fees⁶ |

|---|---|

| Services | Barclays Bank PLC is regulated by the FCA. Features of the Select Cashback⁷ credit card include:

|

| Annual percentage rate (APR) | 27.5% variable dependent on circumstances |

| Interest rates | 27.5% variable dependent on circumstances |

| ATM Withdrawals fees | 2.99% |

| Foreign currency transactions | 2.99% |

| Cashback or rewards | 1% cashback, exclusive rewards and discounts |

American Express is a well-known global brand. To apply for the American Express Business Gold Card you must be at least 18 years old, have a permanent address in the UK, have a business bank or building society account, and be prepared to pay fees after the first twelve months.

Other American Express cards you can consider are the American Express® Business Platinum Card, British Airways American Express® Accelerating Business Card, Amazon Business Prime American Express® Card, Amazon Business, and American Express® Card.

| Features | Fees |

|---|---|

| Services | American Express is regulated by the FCA. Features of the Amex Business Gold Card are:

|

| Annual percentage rate (APR) | This is a charge card so balances must be paid in full each month. A £12 late payment fee will apply |

| Interest rates | This is a charge card so balances must be paid in full each month. A £12 late payment fee will apply |

| ATM Withdrawals fees | 3% (£3 minimum) |

| Foreign currency transactions | 2.99% |

| Cashback or rewards | Reward points and access to exclusive business rewards |

The business credit card from NatWest is for holders of a NatWest Business Banking account in the same legal entity name with NatWest whose business has a turnover of up to £2m.

There’s no annual card fee for the first twelve months and no fee after that if you spend £6,000 or more annually. You get a minimum credit limit of £500 and a maximum limit that’s subject to status.

| Features | Fees |

|---|---|

| Services | NatWest is regulated by the FCA. Features of the NatWest Business Credit Card include:

|

| Annual percentage rate (APR) | Representative APR of 24.3% |

| Interest rates | Representative APR of 16.9% |

| ATM Withdrawals fees | 3% (minimum £3) |

| Foreign currency transactions | 2.95% |

| Cashback or rewards | Earn 1% cashback at eligible fuel and electric vehicle charging stations |

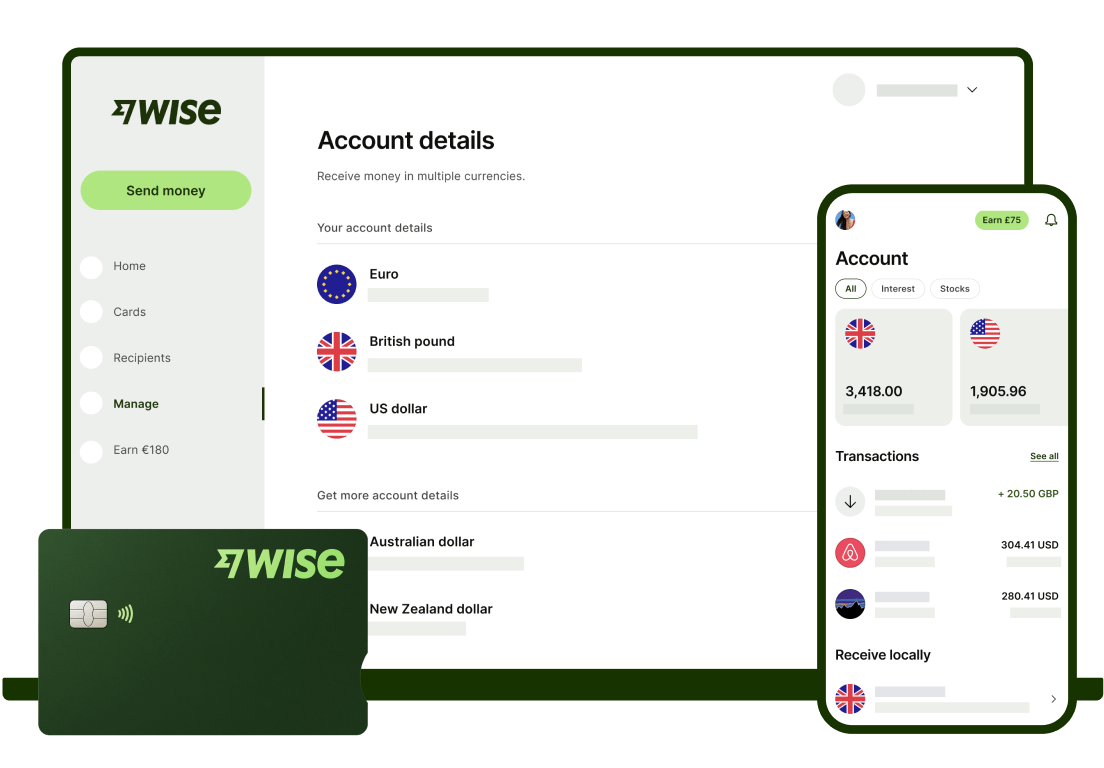

You can efficiently manage your business spending with an easy to use Wise account. The account features help you keep track of your business spending.

You can access to expense cards for your employees, so you can keep control of spending. Plus, you get 0,5% cashback on Wise business cards. Overall, using a Wise Business simplifies your business expense management, so you can spend more time on other areas of the business that need your attention.

Get started with Wise Business 🚀

Efficient management of your business expenses is essential. To make sure this happens, you should keep your personal and business expenses separate. Using a business credit card is one way to do this. You can also use prepaid expense cards or a business debit card. If you decide to apply for a business credit card, choose one that best suits your needs. Pay attention to the features of the card that are most important to you, such as APR, foreign exchange rates, and rewards, and use this information when making your choice.

Sources:

Sources last checked Apr 15, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our complete business guide on importing from Spain to the UK, covering everything from customs to shipping methods.

Read our complete business guide on importing from Türkiye to the UK, covering everything from customs to shipping methods.

Is Tide Bank safe? Find out everything you need to know about Tide Bank business account security here.

Is Revolut Business safe? Find out everything you need to know about Revolut UK security here in our helpful guide.

Read our helpful guide on how to start a business in Romania from the UK, including info on company formation, legal entity types and required documents.

Read our helpful guide on how to start a business in Lithuania from the UK, including info on Lithuania company formation, legal entity types and more.