Wise vs PayPal in Malaysia - Which is better?

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.

This review will walk through the features and benefits of a BigPay Malaysia account, including how to top up BigPay, how to send payments at home and abroad, and the BigPay exchange rate which will be applied to foreign transfers.

Because international transfers are only possible to a limited number of countries with BigPay, we’ll also touch on an alternative way to send low cost secure international payments with Wise. Send, spend and withdraw money internationally on average cheaper than BigPay and Malaysian banks. Read on for more.

| Table of contents |

|---|

BigPay offers a free digital account and linked card, to allow you to spend and make withdrawals at home and abroad.

Accounts are opened online, and managed via the BigPay app. There’s no joining fee, although there is an account service fee of 2.50 MYR for inactive accounts where no card transactions are made within the month. That said, at the time of writing this service fee has been waived - and to top off the BigPay benefits, there’s no annual fee, either¹. You’ll need to add a minimum of 20 MYR to your account when you sign up, but can then send or spend that any way you like².

You can track your spending easily - you’ll also have the opportunity to earn rewards when you spend using your BigPay card³.

You can make transfers from your BigPay account to banks in Malaysia, as well as international transfers to the following countries:¹

Any Malaysian citizen or resident aged 18 or over can sign up to BigPay and open an account online in just a few steps. It’s worth knowing that although there are no ongoing charges, there are some fees for services - more on that later.

BigPay is legit and safe to use in Malaysia. In fact, BigPay is a Bank Negara licensed e-money issuer, which follows all regulatory requirements in Malaysia and all other countries it operates in⁴.

If you’re sending money overseas with BigPay, you’ll pay a fee. You may also find that there’s an additional charge wrapped up in the exchange rate used when making an international transfer.

International transfers have upper limits which vary by country. You’ll be notified of the limit for your payment country in the app when you start to set up the transfer.

Here are the upfront fees you need to know about - we’ll cover the exchange rates used in just a moment:¹

| Sending a payment to: | BigPay transfer fee |

|---|---|

| Malaysia | 0.5 MYR |

| Vietnam | 8 MYR |

| Bangladesh | 6 MYR |

| India | 3.5 MYR |

| Indonesia | 4.5 MYR |

| Singapore | 4.5 MYR |

| Nepal | 6 MYR |

| Thailand | 10 MYR |

| The Philippines | 6 MYR |

| Australia | 13 MYR |

| China | 22 MYR |

| UK | 6 MYR |

| European Union countries | 6 MYR |

Whenever you’re spending money overseas, or if you’re sending a payment to friends or family abroad, you’ll need to know the exchange rates being used as well as the upfront fees you’ll pay.

In terms of upfront fees for international card withdrawals and spending, you’ll usually pay under 1% in total taking into account both the BigPay fee and the network’s own fee. The exchange rate used will be the one Mastercard or Visa sets, depending on the issuer of your particular card¹. The good news is that the network rate is usually pretty fair. However, if you’re sending a bank transfer overseas, the rate used may be different.

You can check the exchange rates which will be used for your international payment, using the BigPay app. Before you decide to make a BigPay international transfer, it’s worth comparing the rate given against the mid-market exchange rate for your currency, which you’ll find with a simple Google search or from an online currency converter.

This is a good benchmark because it’s the rate banks and currency services get when they buy foreign currency on the global markets. By comparing the 2 rates you can see if a markup has been added. Customers may find that they can get a better deal when using a transfer service like Wise, which strictly uses the mid-market exchange rate with low, transparent fees.

BigPay offers a simple and convenient payment service - but you can only send money to a limited number of countries. And you don’t necessarily get the mid-market rate, which can push up the costs.

If you need to send a payment to a country BigPay doesn’t cover - or if you simply want to compare the costs of alternative providers to make sure you’re getting the best possible deal, try Wise.

Learn more how BigPay vs Wise compares here.

An independent research found that it is on average cheaper to send, spend, and withdraw money overseas with Wise compared to BigPay and Malaysia bank accounts.

- Send money to 80+ countries

- Receive money for free in 10 currencies (including MYR, USD & SGD)

- Hold and convert 40+ currencies in 1 single account

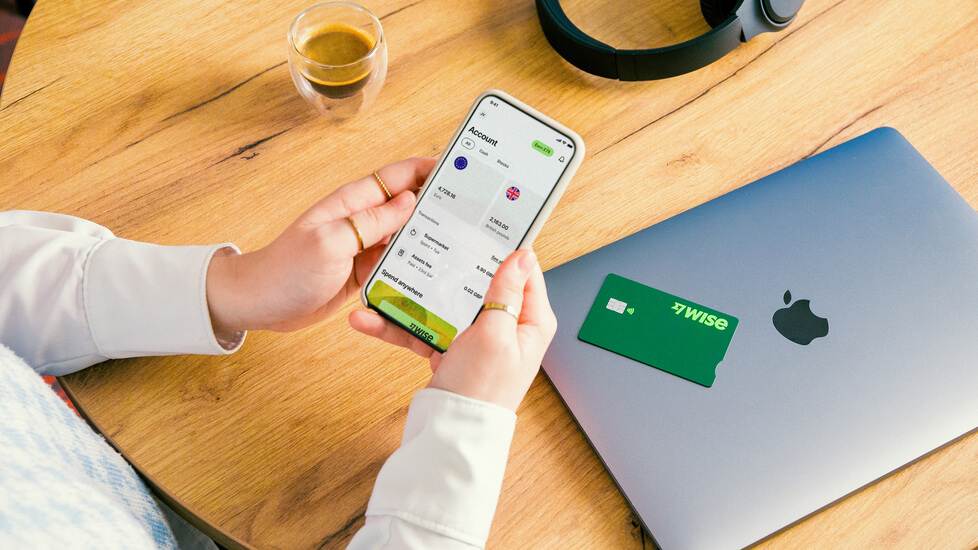

- Get a linked Visa debit card to spend at home or abroad

- Spend in foreign currencies with low conversion fees

No monthly charges or minimum balances required 😉

| 💡 Join over 10 million people who use Wise to save money on pricey interntional transfer fees. |

|---|

When you open a BigPay account, you’ll also get a linked BigPay card. Once you’ve activated your card you can make contactless payments at home and abroad.

You can make payments online and in person, and unlike with a credit card, you won’t be able to accidentally overspend as you can only access the funds you’ve added to the account. Manage the card from the BigPay app, to view transactions, freeze and unfreeze as needed. You’ll have to make a one off payment of 20 MYR to receive your physical BigPay card.

Read more in our full review of BigPay card in Malaysia.

Your BigPay card⁵ can be used for ATM withdrawals as well as payments. You’ll be charged 6 MYR for withdrawals in Malaysia, and MYR10 for international withdrawals⁷. There’s a limit on how much you can withdraw - the BigPay withdrawal limit is 10,000 MYR or up to 10 successful withdrawals daily, but ATM operators may also impose their own limits, too.

It’s also worth noting that some ATM providers charge fees, too, which are in addition to the BigPay charges listed here.

Read more here how to use BigPay overseas

Before you can get started with BigPay you’ll need to add money to your account. Here’s how:⁶

You can use your BigPay card wherever you see the Mastercard or Visa symbol for payments and withdrawals. You can’t use a BigPay card in Russia, North Korea and Israel⁹.

BigPay is a helpful service, with some strong features - especially if you’re spending and making withdrawals here in Malaysia. Accounts are free to open - and because you’ll be managing your money online and via the BigPay app, you’ll never need to wait in line in a bank branch again.

That said, if you need to send payments overseas, or if you travel regularly, you’ll want to review the limitations and fees applied to cross border transactions with BigPay.

For more flexibility, and payments to a broader range of countries, it’s worth considering an alternative service like Wise. You can send money to 70+ countries using the mid-market exchange rate - and with a Wise multi-currency account, you can hold foreign currencies, send and receive international payments and spend all around the world with the linked debit card. The service is fast, convenient, and could save you money. Get started with Wise today, for a smart way to send international payments.

If you have the BigPay app you can contact BigPay customer service 24 hours a day using in-app chat. Alternatively, you can get in touch by email on support.my@bigpayme.com or call 1300-13-3388⁷.

When you open your BigPay account there’s a one time 20 MYR minimum deposit - but you’re then free to spend this any way you like. There’s no minimum balance once your account is up and running.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.

If you shop online, send or receive payments with PayPal, you should understand the transaction fees and charges in Malaysia. Read on for all you need.

Sunway Money offers international transfers from Malaysia to 60+ countries, with funds being deposited directly into bank accounts around the world in a range...

Looking to make an international transfer with BigPay? We reviewed the fees and limits, and compared the cost with an alternative provider Wise.

Here's how to transfer money from PayPal to your Malaysian bank account from your PayPal account

Not sure whether to use InstaRem vs Wise to send money abroad? We compared which could be better for international transfers in Malaysia.