Your Christmas Dinner in numbers

Tis the season to eat a lot of yummy food, so Wise has teamed up with the food-and-culture expert and Chef, Mallika Basu as part of our Christmas Without...

I'm Dr Melissa Hoban, a specialist clinical psychologist working across the NHS, charity sector and private practice. I specialise in working with trauma and using Compassion Focussed Therapy. I am the founder of Myndoodles, which creates mental health illustrations and resources (you can find us on Instagram, Patreon and Etsy). I set up Myndoodles to disseminate mental health knowledge outside of the therapy room. So much of our wellbeing can be protected through understanding what we are feeling, and sharing how normal it is to feel.

It has been a privilege getting to read the stories of the previous writers. Particularly hearing the strong message throughout the articles that sharing and normalising the impact of our mental health on our finances is protective for wellbeing. Yet our finances can feel so personal; people struggle to talk about money in general, and when we feel out of control with our money, the shame this can bring sadly can feedback back into the cycle of overspending. So, I am here to share some of the theories behind how our mental health can impact our finances to hopefully normalise this experience and consider ways to support ourselves when experiencing difficulty. I will use a model called Compassion Focussed Therapy (CFT), mainly as it is an approach brilliant for relieving the silencing grasp of shame.

CFT focuses on the context we are in to understand what we are feeling and our behaviour. It uses evolutionary theory to understand how our emotions have evolved to represent unmet needs. So, our emotions and behaviour are regulated by our motive to meet those needs. Yet the world these days looks very different to the one our emotions/behaviours evolved in, and so through no fault of our own, sometimes the way our mind reacts to how we feel no longer meets our needs. Below are some examples of the pitfalls of our emotion regulation system and how this can impact our finances:

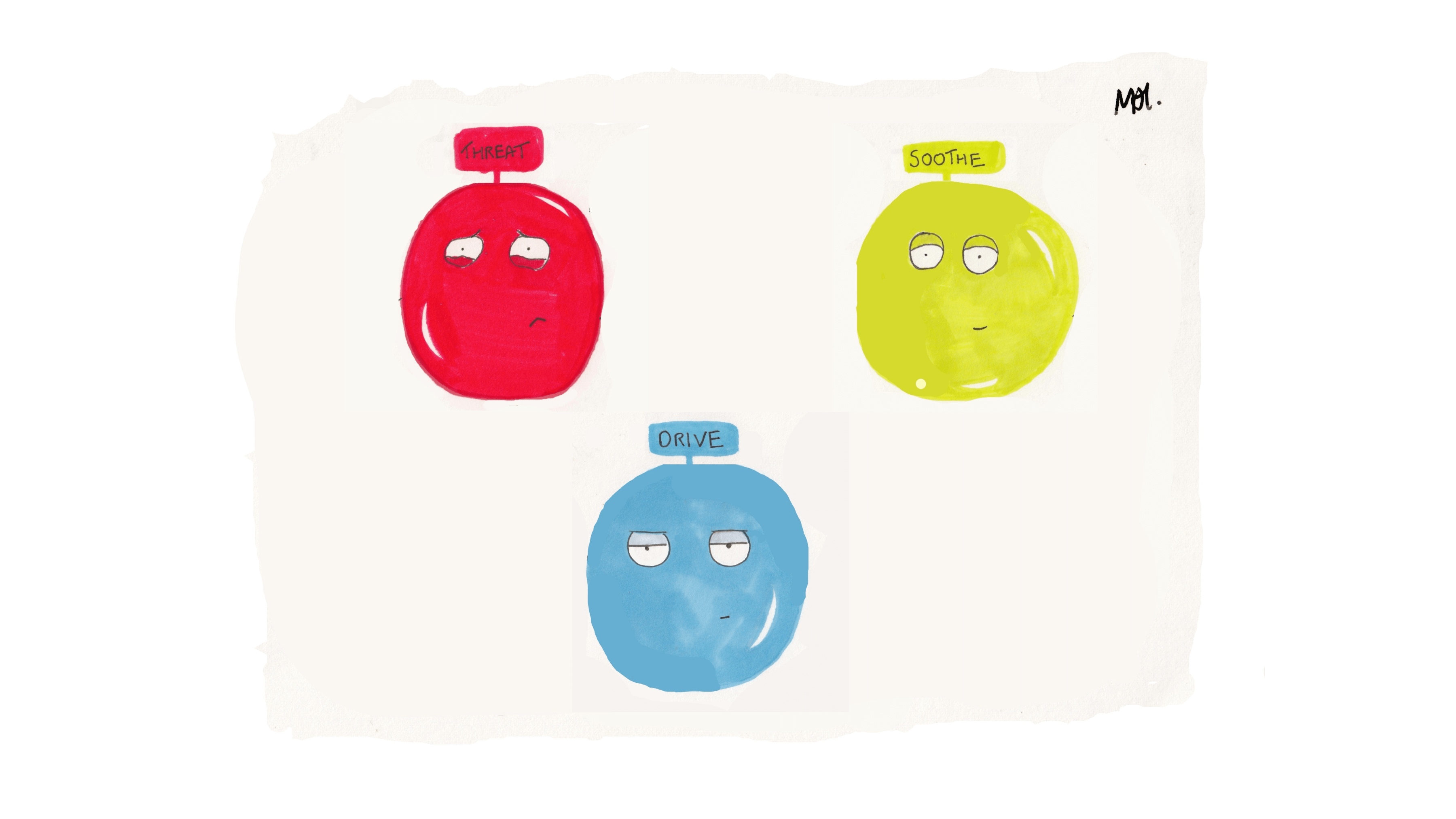

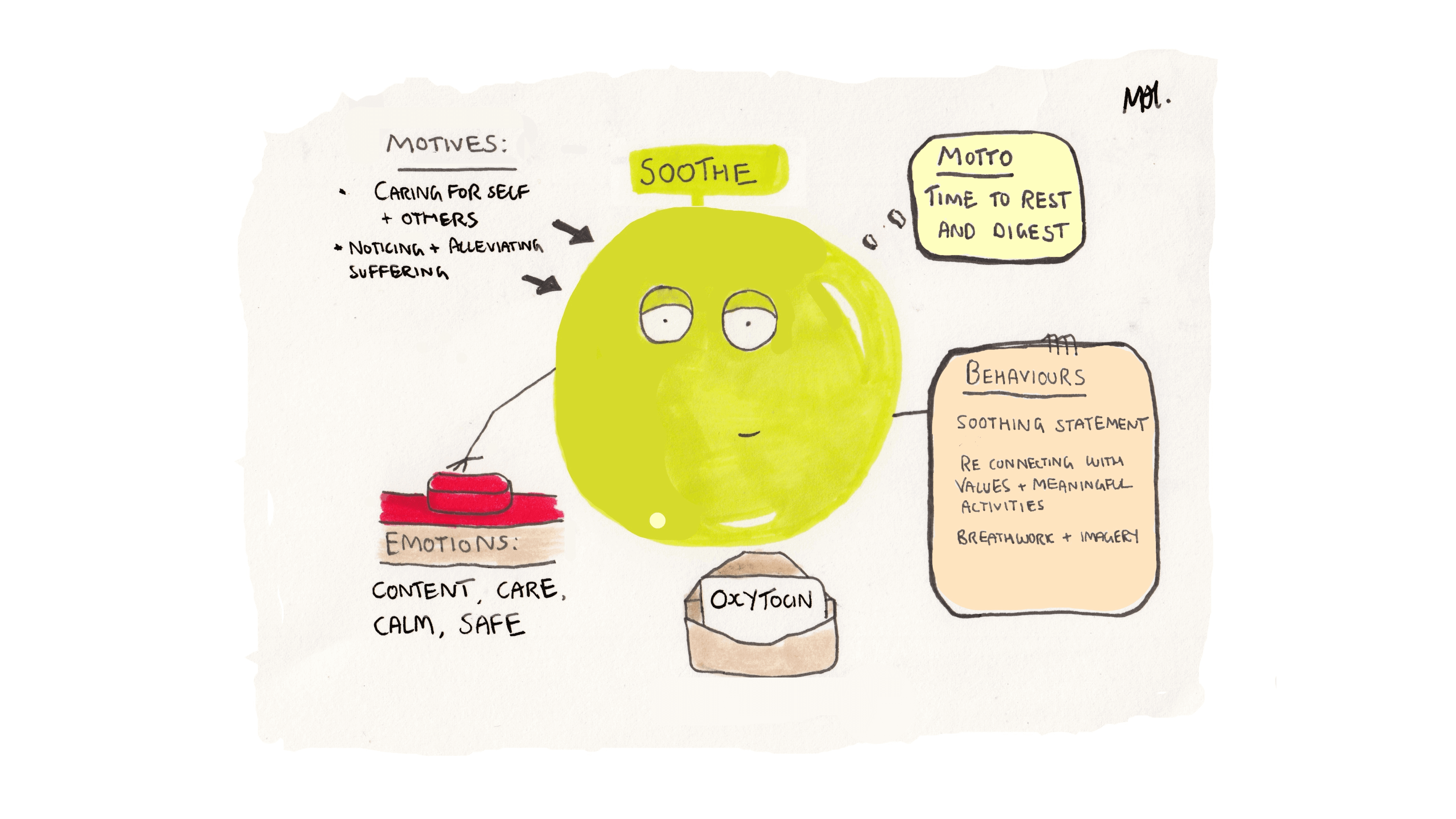

Our emotions are regulated by three central motivation systems that we have as human beings: to keep ourselves safe from danger (our Threat system), to achieve our goals (our drive system) and to rest/digest (our soothe system). For brevity, I will mainly speak about our drive system, a very important one for our finances, but I will put a link at the bottom to learn more about this model. When these three systems are balanced, and we can move between them depending on our face, our wellbeing is protected. Yet often, our earlier experiences, genetics, and current environment can mean a system can become overactivated, impacting our mental and financial wellbeing.

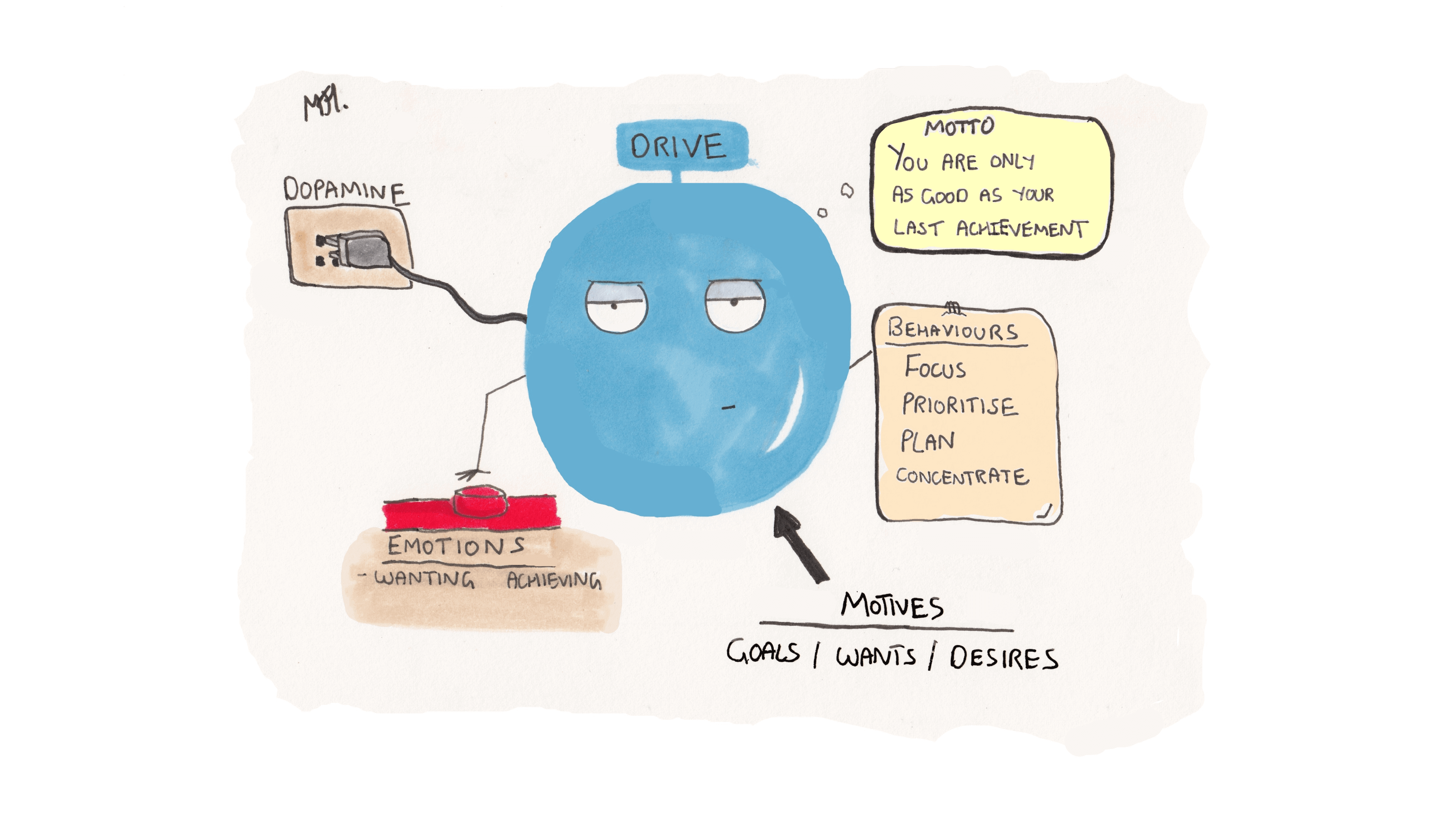

Our drive system is all about getting our goals met. We feel emotions like striving, wanting, and achieving, and these activate our behaviours to get that task done. And when we get that task done, we get a huge hit of dopamine, our reward neurotransmitter, which feels amazing, so we are motivated to achieve again. This has fantastic impacts on our ability to move through life; to progress in our careers, relationships, hobbies and earn a living. For example, if we have a deadline we need to meet, we focus/prioritise that task, complete it and are rewarded for that effort.

But there is a trickier side to Drive. Sometimes, we face situations beyond our control, e.g., a deadline involving other people or organisations, or we won’t get the desired outcome despite how hard we work. In this case, our Drive gets the sense of accomplishment it is lacking by seeking accomplishment in another area, and for some, this can be through spending. We buy that plant/ item of clothing/furniture/sports equipment, and we get rewarded with dopamine, reinforcing that association. Whilst we continue to feel out of control, our Drive system will go to spending to regain the balance, which can significantly impact our spending habits.

Furthermore, our Drive system has a motto, “You are only as good as your last achievement,” to continue pushing us forward. If we live in Drive to regain control, we can see a behaviour quickly escalate. In terms of finances, that item is no longer enough; we need more to get the same hit. We may find ourselves buying a little more and more, until we face multiple online tabs, shopping bags, increasing debt, and a feeling of being trapped.

Our Drive system also needs time to recharge - like a laptop will power off if it runs out of battery, our Drive system will run out of dopamine without rest, which can lead to burnout. Here, we will feel a loss of motivation and pleasure, like we don’t care anymore about things we used to. In fact, it may be hard even to consider getting out of bed in the morning, taking a shower or eating food. This was picked up on in many of the previous articles, that when Drive burns out, being able to make a plan for finances is beyond our capacity. We also may be more likely to spend without thinking in an attempt to jump-start our motivation. Sadly, as this is a goal, it is trying to draw from the Drive system, which is empty – similar to pushing the on button, hoping the laptop will spark back up.

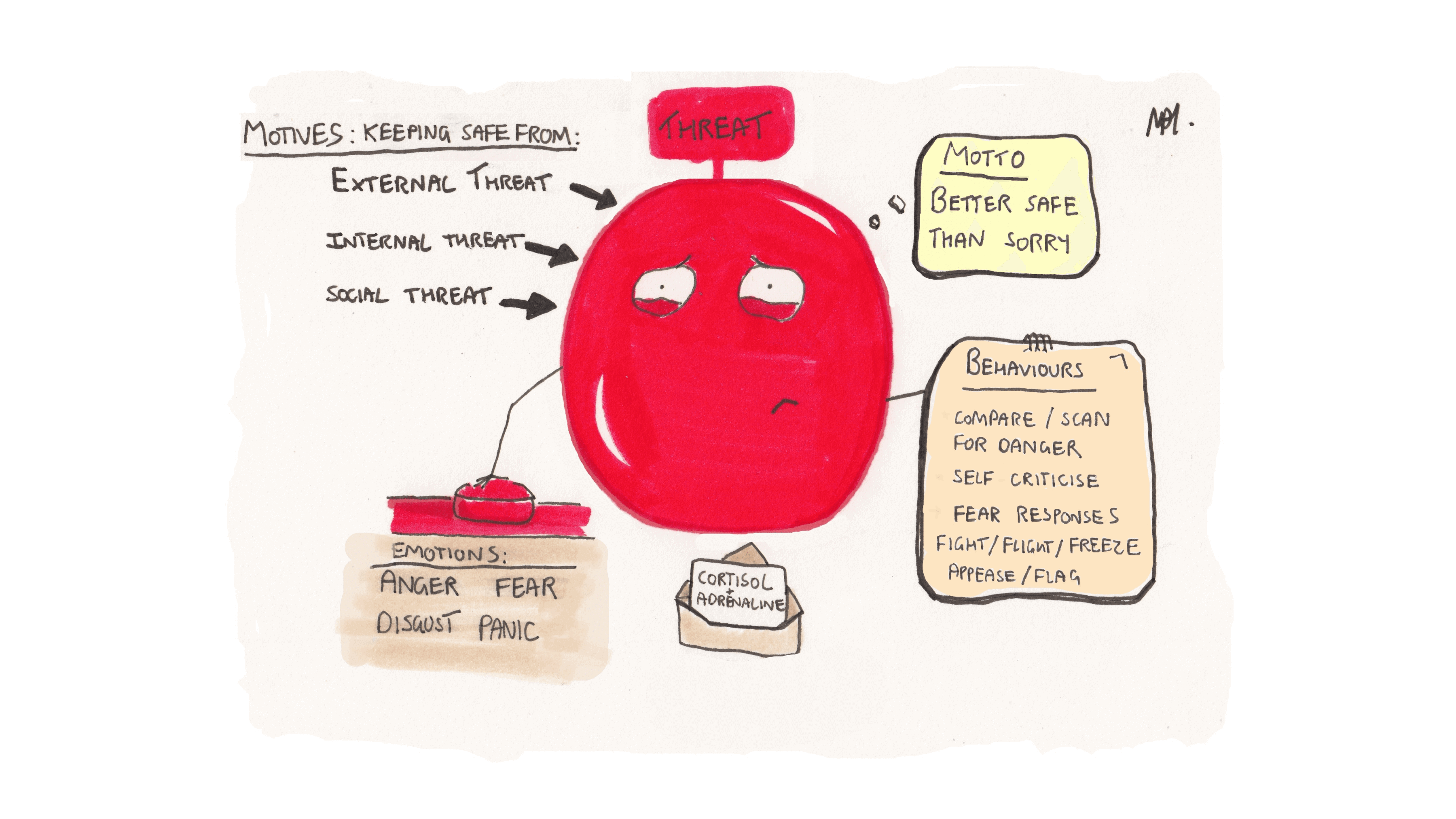

Finally, most of our mind is geared towards the first motivation – to keep ourselves safe from danger. This is our Threat system; its main job is to alert us when we are unsafe. It regulates emotions such as anxiety, fear, and disgust; when we feel these, it triggers our body to make a fear response to get us out of danger. For example, if we see a bear, we feel afraid, we freeze, and the bear walks away. In our modern world, however, threats are often not as simple as a bear; they can involve internal beliefs about ourselves, other people or the world in general (I’m not good enough, Others will judge me, The world is dangerous). These still trigger the same fear responses, but these behaviours aren’t helpful when faced with an internal threat – how do we fight or flee from a thought?

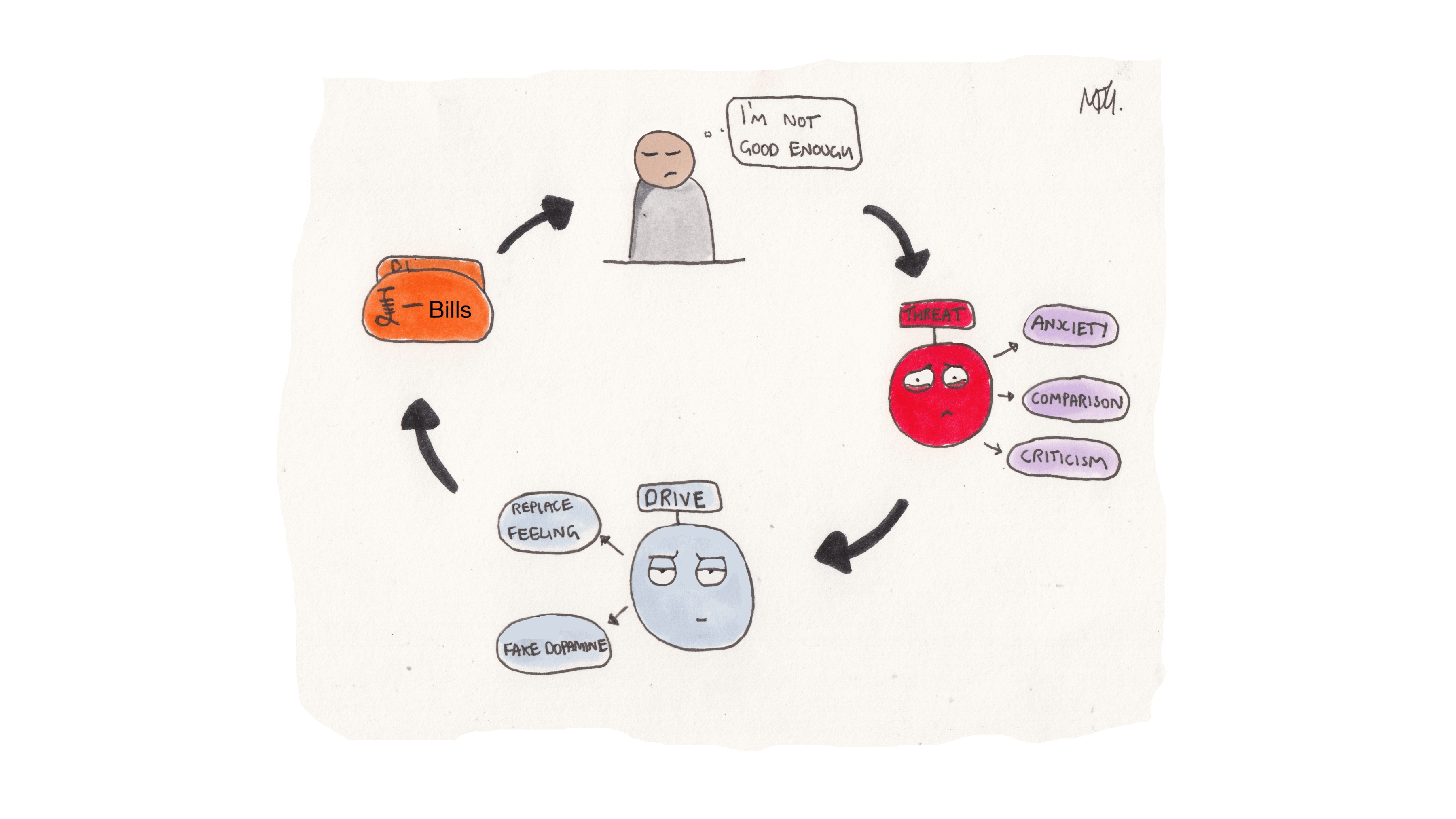

This is where Drive can come in to try to replace the bad feeling with a good one or to see it as a goal to prove wrong. This can sometimes be helpful, but if Drive is the only system trying to regulate Threat it can create a shameful spending cycle, like the below example:

This is a nice example of how tricky the human mind is; it is unfair that our mind is judging us for the very behaviour it suggested to deal with our pain in the first place.

So, how do we break out of this? Our soothe system! When Soothe is activated, it uses a different nervous system than our other two, so they are switched off. This gives our Drive the much-needed time to recharge or reset its motto so we can enjoy our achievements and see our progress. It also allows our Threat to be turned off, giving us space to choose how we want to respond. We can balance Drive by:

Emotion Regulation Systems more detail

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Tis the season to eat a lot of yummy food, so Wise has teamed up with the food-and-culture expert and Chef, Mallika Basu as part of our Christmas Without...

Millions of people around the world travel over Christmas, Hanukkah and Kwanzaa. In 2022 alone, 77,000 flights took off on Christmas Day globally. That may...

Salt-N-Pepa the iconic hip hop group = ❤️ love Salt and pepper, AKA the only seasoning I used as a university student = 🥲sigh Taking the Spice Girls advice...

The festive season is upon us, and it’s pretty much the same deal every year: Shop for gifts last minute Eat like a Sumo wrestler in training Travel to see...

We've teamed up with personal finance expert, Kia Commodore to help give your money a kick up the backside so you can go ahead and sleep. “Lazy Money” is what...

We've teamed up with personal finance expert, Kia Commodore to help give your money a kick up the backside so you can go ahead and sleep. “Lazy Money”...