A review of fees: Major routes got cheaper while some fees went up

We changed many of the fees on Wise this week. Some of you benefited as a lot of routes got cheaper, but some of you will also see an increase in some...

Whether you have an online shop, provide freelance services to clients or sell travel tours, recommending Wise is a great solution for anyone who receives money from customers via a bank transfer.

When your customers pay you via bank transfer in a foreign currency, their banks will charge international banking fees and apply a marked up exchange rate. This means you receive less money due to hidden fees, that customers don’t know about, or they end up paying the big markup on the transfer, which makes paying for your goods or services becomes much more expensive.

In this guide for our affiliate partners, we want to help you save money for yourself and your customers, as well as let you earn commission for each new user you refer to Wise.

In this post, you will find information about:

Help your customers save on international payments by recommending Wise as your preferred payment option.

Being part of our affiliate program and using your tracking link to send customers to Wise also means you get a commission for each new user who signs up and makes a cross-currency transaction.

Find out more about Partnerize, reporting and getting commission here.

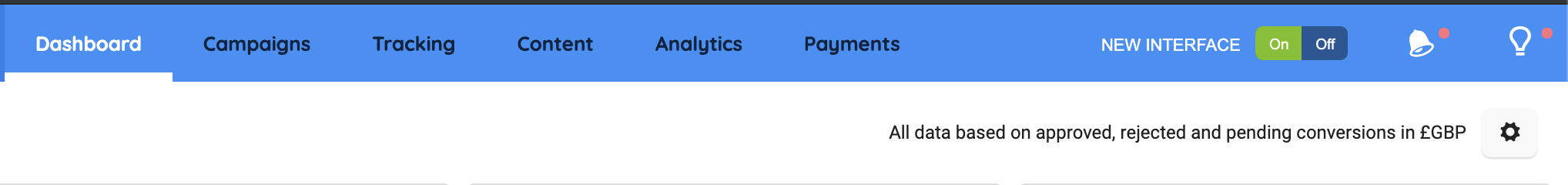

Log into Partnerize and find your tracking link under ‘Tracking’ in the top navigation bar.

You can use your text link to recommend Wise to your customers or you can include our logo on your website.

If you would like to have a co-branded, customised landing page on the Wise website – email partnerwise@wise.com and include following:

Example co-branded landing page

You can include the following information on your invoice, payment FAQ page or email requesting for payment.

If you are paying us in a foreign currency, we recommend using [Wise]. It’s up to 8 times cheaper than using your local banks, because Wise always use the real exchange rate – which you can see on Google – and charges a very small, upfront fee. They’re also safe, and trusted by over 10 million people around the world.

You can sign up here, and check out this PDF (included below) to see how it works.

Create a Wise account and send a transfer to our bank account:

Invoice amount: $4,000

Bank account details: 1234 5678 1234 5678

Note - hyperlink the word ‘Wise’ with your tracking link

What is Wise?

Wise is the global technology company building the best way to move money around the world.

Wise offers an international account with over 50 currencies, with instant, super-cheap money transfers, and a card to spend in any currency. Wise is on average 7x cheaper than old-school banks when you send, spend, or withdraw money around the world.

How to send money with Wise?

Other features of the Wise account

1. How much does it cost?

Wise always uses the mid-market exchange rate and charges a small fee for sending money.

The transfer fee depends on the currencies and the amount of the transfer. Visit the pricing page to find out exactly how much money you need to pay for our services by using their currency calculator.

Find out more about how Wise sets prices for transactions here.

2. How long does a transfer take?

30% of all transfers are instant and over 75% of our transfers arrive within 24 hours. Depending on the currencies you are sending, how you choose to fund your transfer and any security checks the delivery time may vary.

You can always check the status of your transfer in your Wise account.

3. Is Wise safe?

Yes. Wise is regulated by the Financial Conduct Authority (FCA) in the UK, and many other regulators around the world. They hold Wise to the same standards as banks.

Wise also has great customer support; you can reach them any time by phone, email, or social media. More info here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We changed many of the fees on Wise this week. Some of you benefited as a lot of routes got cheaper, but some of you will also see an increase in some...

Kami meninjau biaya-biaya kami secara rutin untuk mencerminkan biaya sebenarnya dalam memindahkan uang Anda, sehingga Anda tidak perlu membayar lebih daripada...

This blog post is to update our customers about changes in price and is not a marketing communication. We regularly review our fees to reflect the real cost...

Here are our top tips and potential pitfalls when sending money from China* using Wise. This service is provided in partnership with a third party payment...

We're excited to announce that Wise is launching a transfer service to help expats to send money from China.* Wise now supports Chinese Yuan (CNY) transfers...

Hi Affiliates, Since we last updated this page, Wise has undergone some changes. We’re no longer called TransferWise, and have undergone a rebrand -...